I Live Paycheck To Paycheck How Can I Save Money

Are you struggling to put money away each month, whether it be from lack of income, spending more than you make, or you just suck at saving? If so, you've come to the right spot!!

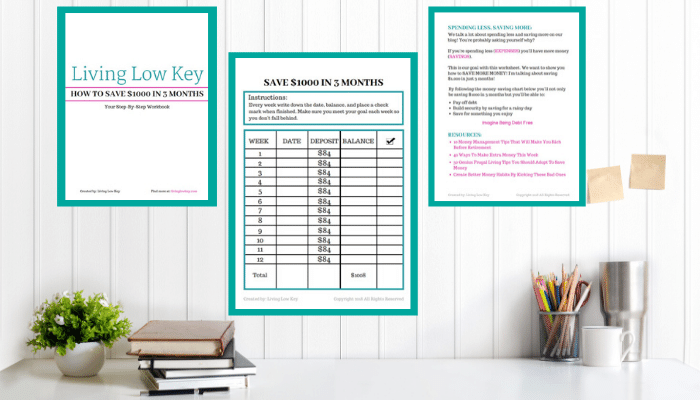

I made thismoney saving chart just for YOU! You're here because you want to knowhow to save $1000 in 3 months.

I'm going to show you exactly how to start saving money RIGHT NOW, but YOU have to take action, and YOU have to put in the work to reap the rewards.

Not spending more money than you make is challenging! It sucks that it's a reality, but here in the U.S., it is!

We've all tried saving money before. Hopefully, most of us do it on a monthly basis.

If not, today is a great day to start!

I'm going to give you my very best advice on saving money (Don't forget we saved $100,000 in 5 years as a single income household, while paying off our debt). And no it didn't come easy.

Implement these steps and follow along with our money-saving chart, and you will save hundreds to thousands of dollars this year!

Make sure you sign up to receive your FREE $1000 Money-Saving Worksheet below. This money-saving chart will be your guide through saving your first $1,000 over the next three months.

Related Topics:

- The Only Tool You'll Ever Need To Master Your Money

- 11 Money Saving Challenges (The Quick & Painless Way to Save Money)

- How To Begin Living Below Your Means And Appreciate The Journey

- Living Cheap: How To Live Cheap And Still Thrive

The Importance Of Saving Money For Your Future

Most people have a hard time deciding between saving for the future or living for today. In the back of our minds, we all know we should be saving for the future, but it only takes a second for that little voice in your head to switch to, "live for right now, buy the shiny new object," and the next thing you know you're walking out of the store with a new $1000 phone.

How do you FIGHT that voice?

This phenomenon happens way too often, and it happens to everyone. This is why you need to find your WHY behind your goal of saving money.

Why do you need to save $1000 in 3 months? Find your "why" and write it down. Stick it somewhere you will see every day, and let's get this party started.

"You must learn to save first and spend afterwards !" – H. John Poole

Reasons WHY you might want to save $1000:

- Pay off your debts

- Take a vacation

- Create an emergency fund

- Live a debt free life

- Retirement

How To Save More Money Each Month

We talk a lot about spending less. To reach your $1000 goal, you're going to have to cut back on your expenses so you can start saving. This is where the magic will happen!

We highly recommend setting up a budget. If you don't have a budget in place grab our FREE Budget Binder below!

Get Your FREE Budget Binder Today

It's time for you to take control of your finances so you can save more money and pay off your debt!!

You're so close to getting your Free Budget Binder printables. Shortly you will be receiving an email from us. That email will contain your Free Budget Binder!! Make sure you check your spam box just in case it ends up there and then add us to your known contacts! We're excited to have you in our Living Low Key community and can't wait to help you reach your goals!

With the Budget Binder, you'll be able to see exactly where your money is going.

We love using the Cash Envelope Budget System. The famous Dave Ramsey highly recommends it. If you haven't already, you can check out what he's all about here.

This is the system we used to save $100,000!!!

Here are more ways to save more money:

- 11 Money Saving Challenges (The Quick & Painless Way to Save Money)

- 10 Awesome Hacks That'll Save You Thousands On Your Household Items

- 50 Genius Frugal Living Tips You Should Adopt To Save Money

- Living Cheap: How To Live Cheap And Still Thrive

The BEST books on saving money!

I Live Paycheck To Paycheck, How Can I Save Money ?

I already live paycheck to paycheck, and I have no money left to save, how can I possibly do this type of money-saving challenge.. Does this sound like you?

I hear this A LOT.

How do you save money if you already live paycheck to paycheck? I'm not going to sugarcoat it for you, it takes a little sacrifice, but you can do it!!

The funny thing is most people who live paycheck to paycheck make a good amount of money. Or at least have enough to live off of each month.

They just live beyond their means and spend more money than they make.

If you're currently living paycheck to paycheck, here's what I want you to do… before starting this 3-month money saving challenge. Take one month and write down every single dollar you spend, every dollar your husband spends, and every dollar your children spend.

EVERY LAST DOLLAR!!

Having the right tool makes this task really simple. Check out this total money management tool!

At the end of the month, I think you'll be pleasantly surprised at what you notice. I guarantee that you will see that there were quite a few items you could have cut out of your spending.

If I'm wrong, this next section is for you!

Related Resource: Stop Living Paycheck to Paycheck: Pay Off Debt and Start Saving Money

How To Make Money Fast

Being able to save $1000 with this money-saving chart is a huge step towards you reaching financial freedom, or whatever financial goal it is you're trying to reach.

However, if the money is just not there and you can't cut your spending any further, it's time to start thinking about how you can make more money.

1. Get a part-time job

If you've exhausted all of your options and you can't manage to save another dime, get a part-time job. I know a part-time job might be a lot to add to your already full plate, but it's only temporary.

Related article: 15 Easy Side Jobs For Teachers (The Best Summer Gigs)

2. Sell second-hand books

Do you have textbooks or electronics lying around your home that you don't use? I know many of you still have old textbooks stuffed under your bed or in your closet.

If so, you have to try the Amazon trade-in program. All you do is enter your book's ISBN, and then Amazon will give you a trade-in price. They even send you postage, so shipping is free. In return, they send you a gift card with Amazon dollars!

I sent 12 of my old textbooks in and made over $300. So make sure to check this out!

3. Take online surveys

Are you ready to get paid money simply to give your own opinion? If so, you're going to love online survey sites such as Survey Junkie.

You spend a few minutes taking a survey, and then they pay you cash. If you have downtime, this is a great way to make some extra money.

A few of my favorite reputable survey sites you need to check out:

- Vindale Research

- My Points

- MySurvey

- i-say

- YouGov

- InboxDollars

- OneOpinion

4. Start your own website

Are you extremely passionate about cooking, traveling, mom life, DIY, or crafts? Do you have a love for writing?

What if I told you that you could make thousands of dollars BLOGGING about your passion?

Well, you can!!

Our blog made us over $20,000 in a single month!

Start your own blog today and learn how to make money doing something you love.

Related Resource: How To Make Money Blogging This Year

5. Get cash back when shopping with Rakuten

This is one of my favorite ways to make extra cash!

Why you might ask.. Because you can make a lot of cash using it!

Rakuten is super self-explanatory. Next time you do online shopping at stores such as American Eagle, Khols, Target, Macy's, or any other of their 2,000 stores, head over to Rakuten.

On the Rakuten website, click on the store you're doing your shopping at and then shop away as usual.

Rakuten will pay you a cash back bonus just for shopping through their site. It's free, and it's easy!

Use OUR LINK, and when you spend your first $25, you'll get a free $10 cash back welcome!

You can check out our Rakuten review here!

6. Babysit

Nowadays, babysitters make a lot of money!! Parents pay big bucks to make sure their children are in a safe environment while they're away. If you love kids, you can easily make $10-$20 an hour babysitting.

Jump on Care.com today and find work in your neighborhood.

7. Sell your clothes and other household items

There are so many different places you can sell your used items. This makes it super easy to make cash fast!

Here's a list of the best places to sell your used clothing and household items:

- Marketplace (on Facebook)

- Facebook garage sale sites. Just about every town has their own personal online garage sale site where you can sell used items.

- Craigslist

- eBay

- Amazon

- Local thrift shops

Related resource: 10 Awesome Hacks That'll Save You Thousands On Your Household Items

8. Swagbucks

Do you want to earn gift cards for items you're purchasing online? Shop online like you normally would at sites such as Amazon, J. Crew, Home Depot, and many others (they partner with over 1000 different stores).

Swagbucks will help you find the best discount for the item you're looking for. In return, they give you points for shopping through their site. You can then redeem those points for gift cards to your favorite stores.

Make sure to check out Swagbucks next time you do your shopping online.

9. Start a side hustle from home

Winter is upon us, do you know what that means? Your neighbors are going to be looking for someone to shovel their sidewalks and driveways.

Don't get snow where you live? Well then, maybe your neighbor is looking for a hand building a deck or doing yard work.

If you have a talent that others might need, take your skillset, and do something with it. Don't forget to let them know it isn't free!

Related article: 40 Ways To Make Extra Money This Week

10. Rent out a room in your house

Hello Airbnb!! Do you have an extra room in your house that you aren't using?

What about a camper you're not using every weekend? Or any other unique place in or outside your home, heck even a treehouse.

You can rent out these spaces using Airbnb for extra cash! We've used Airbnb a handful of times, and we've only had great experiences.

We stayed in an Airbnb in Belize and loved it. Check it out here!

Remember, these are just a handful of ways to make a quick but. The sky is your limit!!

How To Get $1000 Fast Using The Money Saving Chart

Remember we already went over the keys to saving $1000 in just three months:

- Spending less, saving more

- Budget your money

- Get a side hustle/ increase your income

How This Money Saving Chart Works

Every week for 3 months, you will need to save $84. Does that sound like a lot? It might, but I just gave you numerous ideas on how you're going to find the extra money to do it!

Think about it; you only need to make an extra $12 a day to hit your goal in 3 months! Skip that Starbucks coffee or bring your lunch to work with you!

If you don't want to skip your Starbucks coffee, I wouldn't want to either. Here are 10 simples ways to score FREE Starbucks coffee!

When you look at it that way, it will probably seem a lot more doable.

It's all about spending less!

What did you buy yesterday that you didn't NEED? Next time, don't buy those extra items.

Use the above strategies we talked about, and you'll be golden. Let's make this happen!

Sign up below to download your free money-saving chart below to get started saving $1000 in 3 months!

What Will You Do With The Extra Money

How do you plan to hold on to your extra savings while reaching your goal of $1000? Do you plan to hold onto it in a jar at home or in a savings account at the bank?

If you're looking to hold on to the money short term, and you don't like to have cash on you, I would open a savings account at CIT Bank.

Then automatically transfer $84 into your "new special savings account" once a week or $168 every two weeks.

This way, your money never touches your fingers, and you won't have the opportunity to spend it.

CIT Bank is an online bank, which we use ourselves and absolutely love. They have super high-interest rates so you'll actually be making money off of your money.

Whatever you do, don't let your money sit in a normal savings account at a bank, your money won't grow there.

Best tips for picking the right savings account:

- We're trying to SAVE MONEY, right?? Yes, so please make sure the bank you chose doesn't charge a monthly fee. When I was looking for a new bank when we moved to Minnesota, I was going to open a new saving account at a credit union, and they wanted to charge me $2 per month. Um, no thank you. I'm trying to save money!

- If you don't have debt or are planning to save your $1000 long term for a future vacation, etc. Find a bank with good interest rates. The higher the interest rate, the faster your money will grow! Try doing some research on Money Market Accounts.

- Like I mentioned above, automatic transfers are where it's at! Especially for those of us who aren't good at keeping track of every penny we spend. Save first, spend later!

Okay, so what are you going to do with your extra $1000? Hopefully, not spend it, RIGHT!

Pay Off Debt And Other Expenses

Do you have debt? Sadly most of us do.

I can't even explain how freeing it is to pay off bad debts as soon as you can. You just have to do it and feel the relief!

Bad debts are debts such as personal loans and credit card debt. Do you have any of these? If so, I highly recommend you start by knocking these types of debts out of the park.

Once you knock down one debt, it will free up more of your money each month. Use that money towards knocking down the next debt.

Here's a great tool to help you Destroy Your Debt!

Build A Emergency Fund – Prepare For The Unexpected

You don't have to pay off all of your bad debts to start saving for a rainy day. Even if you're only able to hide away a few dollars a week in your dresser drawer, do it. It will add up, and you will need it for some unexpected emergency at some point in time.

Your goal should be to have your emergency fund equal to 4-6 months of your expenses.

Need help with tracking your emergency fund? Use the Emergency Fund Tracker in our Budgeting Spreadsheets.

Invest For The Future

COMPOUNDING INTEREST is an amazing thing! What if I told you we've made five figures this year JUST OFF INTEREST! Even if we didn't add a dime to our investment accounts this year, we are still making money, a lot of money at that.

I'm not telling you this to brag. I'm telling you this because this could be YOU if you start being smart with your money!

If you haven't already downloaded your FREE printable workbook to save $1000 in 3 months, DO IT NOW! It will change your life.

If you have any creative ways to save money every day, I want to hear them!

If you enjoyed this post, make sure to pin it for later and join us over on Pinterest for more money-saving tips!

Related Articles:

- How To Begin Living Below Your Means And Appreciate The Journey

- How To Stop Spending Money On Unnecessary Things You Don't Need

- 20 Things I Simply Stopped Buying To Save Money

- The Best Free Debt Tracker Printable: Kiss Your Debt Goodbye

I Live Paycheck To Paycheck How Can I Save Money

Source: https://livinglowkey.com/money-saving-chart/

Posted by: broadhurstfolisn.blogspot.com

0 Response to "I Live Paycheck To Paycheck How Can I Save Money"

Post a Comment